are salt taxes deductible in 2020

2 days agoIf you own property in West Valley City expect an increase in your tax bill this year. Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of 2021 the tax filing date for individuals to pay their 2020 income taxes was moved by the IRS from April 15 2021 to May 172021.

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Components such as the tax treatment of 2020 unemployment benefits and phaseout thresholds for economic impact payments were changed.

. Deductions for state and local sales tax SALT income and property taxes can be itemized on Schedule A. COVID-19 the American Rescue Plan Act of 2021. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

The Elderly and Disabled Credit is designed. Taxpayers are allowed to take an itemized deduction for state and local taxes paid on income sales real estate and personal property through the state and local tax SALT deduction. The entire 12000 will be deductible on the federal return as a charitable contribution and the taxpayer will qualify for a 10200 credit to offset state income tax.

There is a limit based on your age and it must be for qualified long term care insurance. State and Local Taxes SALT If any of the above apply its easy to take some. Two big changes in 2020 were self employed people were able to.

For Tax Year 2021 teachers or educators can generally deduct unreimbursed out-of-pocket school trade or educator business expenses up to 250 on their federal tax returns using the Educator Expense DeductionYou do not have to itemize your deductions to claim this. In a cycle that usually happens every couple of years the city plans a 9 boost to its property tax rate. Elderly and Disabled Credit.

In response a number of states have enacted new entity-level taxes on PTEs designed to permit the entity to deduct state income taxes that the individual owners would have otherwise been unable to deduct under the SALT cap. A non-refundable tax credit available for taxpayers who are aged 65 or over or who are permanently and totally disabled. If you and your spouse are both educators or teachers and your filing status is Married Filing Jointly you.

These insurance premiums are deductible to the extent that the premiums exceed 10 of your adjusted gross income AGI. John properly filed his 2020 income tax return. If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses.

The federal tax reform law passed on Dec. Prior to the limits enactment the cost in lost revenue for the federal government for the SALT deduction was estimated at 78 billion and 82 billion in fiscal years FYs 2019 and 2020. In Notice 2020-75 the IRS confirmed that PTEs are permitted to fully deduct entity-level state and local income taxes.

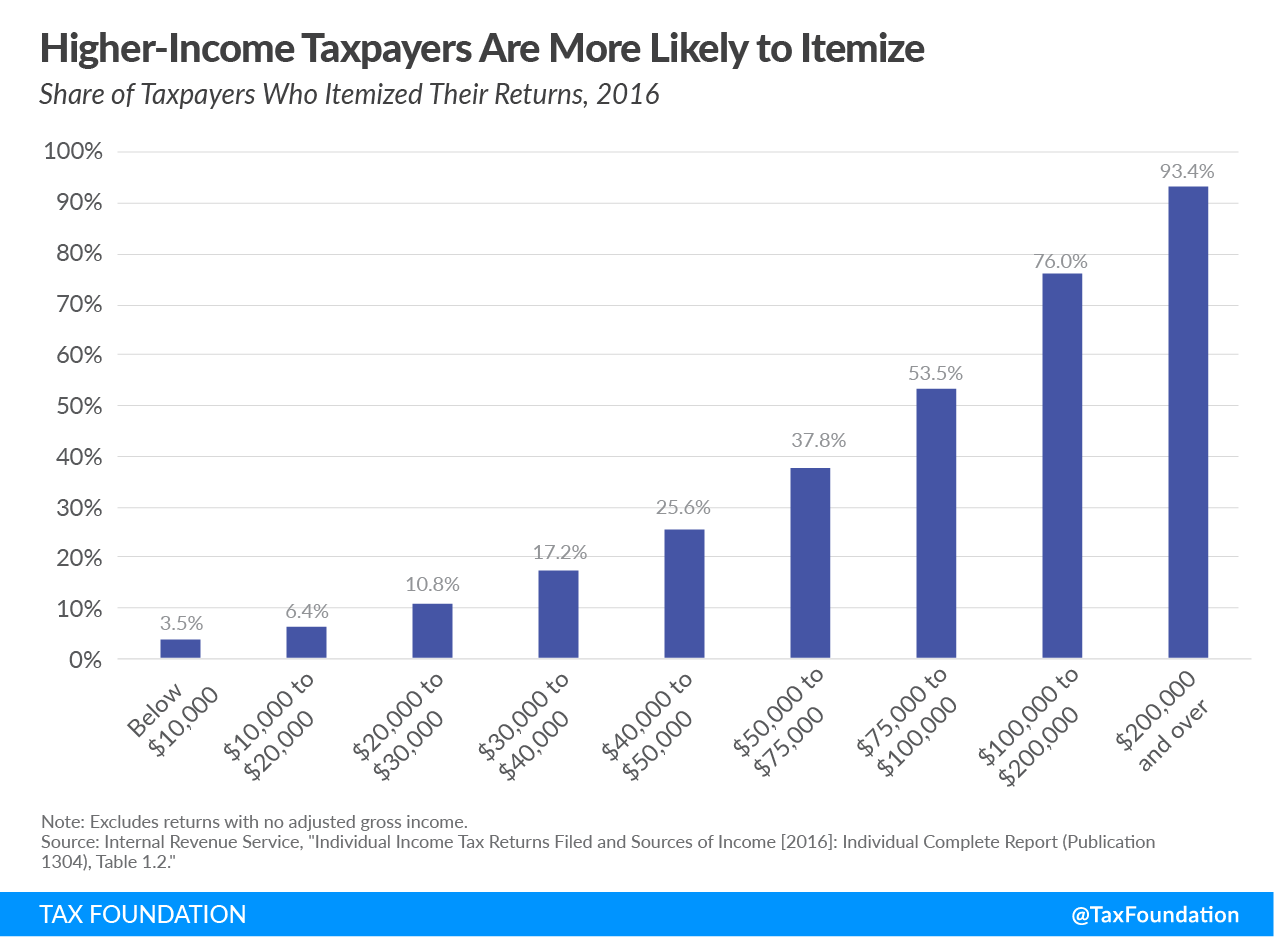

This so-called extender in the Further Consolidated Appropriations Act 2020 reauthorized the deductibility of PMI and FHA MI premiums not only for the 2019 and 2020 tax years but also make PMI premiums retroactively deductible for the 2018 tax year too. The Tax Cuts and Jobs Act of 2017 instituted a temporary 10000 cap on the annual deduction and the number of claimants and average amount deducted fell. He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021.

While income from rent is not tax deductible owning real estate in the long-term is subject to lower capital gains taxes. Is a 501c3 public charity and contributions are tax deductible RELATED STORIES Abortion-rights rally draws about 2500 to Utah Capitol including women who fought. The 2020 SALT deduction The SALT deduction which stands for State and Local Taxes was perhaps the most controversial part of the changes to the individual tax code made by the Tax Cuts and Jobs Act.

The Salt Lake Tribune Inc.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Tax Deductions Lower Taxes And Tax Liability Higher Refund

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Mortage Interest Deduction What Is The Mortgage Interest Deduction

Your 2020 Guide To Tax Deductions The Motley Fool

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How To Deduct State And Local Taxes Above Salt Cap

What Are Itemized Deductions And Who Claims Them Tax Policy Center

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Medical Expense Deduction Which Expenses Are Deductible Medical Financial Advice Tax Help

State And Local Tax Salt Deduction Caps May Get Another Look

Tax Deduction Definition Taxedu Tax Foundation

What Are Itemized Deductions And Who Claims Them Tax Policy Center

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)